Like many other highly-fragmented industries, the equipment rental industry continues to experience frequent consolidations. Although consolidation presents many opportunities for acquirers and sellers, there are challenges that naturally arise as a by-product of these transactions.

One such challenge is undertaking the accounting end of the acquisition, most notably adherence to the guidance offered by the financial accounting standards – in this case, FAS 157 and ASC 820. The acquiring companies need to assign an appropriate “fair value” (not to be confused with the similar-sounding “fair market value”) as they bring those assets onto their balance sheets. But it’s not so easy – accounting standards can often be confusing, oftentimes leading financial teams to consume time and resources only to find out that their application of the rules does not pass auditors’ requirements.

First, a little bit of background on the accounting principles:

Fair Value is measured and calculated in line with the financial reporting standards as established by the Financial Accounting Standards Board (FASB). Fair Value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.

In considering the fair value of the assets owned by the company, it is important to consider both the core valuation criteria as outlined by FAS 157 and FASB ASC 820 (amendments to FAS 157 issued by the ASC), including:

- Measurement Date: this should coincide with the closing date of the transaction.

- Market Participants: Fair Value should be considered from the perspective of the company and considers the price other similar equipment rental / dealer companies might pay for those same assets.

- Orderly Transaction: Fair Value is derived assuming there is no undue pressure or inclination to sell the assets.

So how does one apply the accounting principles into practice?

Much like a traditional retailer who acquires inventory and applies a mark-up for resale, equipment rental companies purchase fleet assets (their equivalent of inventory) for purposes of renting that equipment to their customers. As a result, it is not uncommon for rental companies to purchase assets at a wholesale price point (i.e., a discount to retail prices).

In turn, this phenomenon can make it challenging to arrive at a fair value measurement in the context of an acquisition of used fleet. It takes an experienced partner and a rich source of market observations to accurately assign fair value that will stand up to the accounting guidance and ultimately the auditors’ acceptance of a company’s financial reporting.

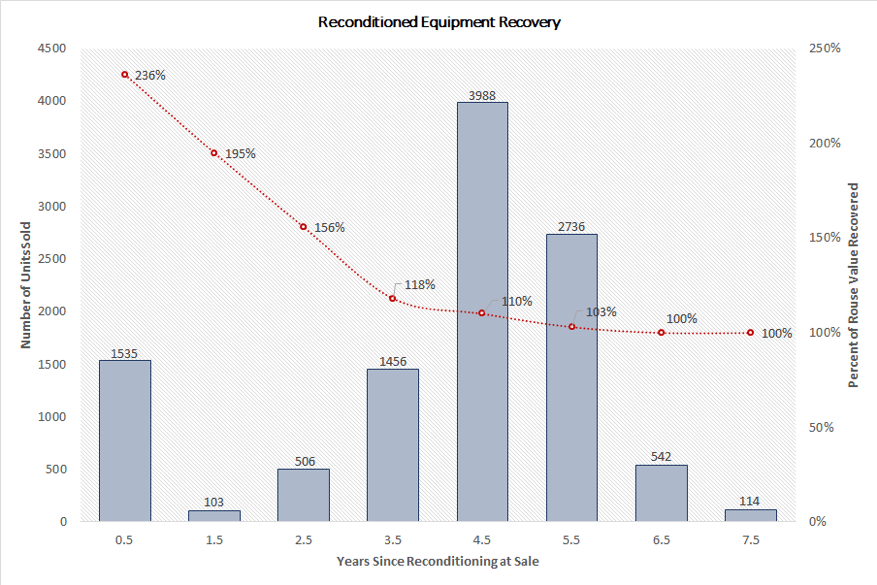

As a result of its extensive network of participants, Rouse receives over $1.5 billion in wholesale equipment sales transaction data annually and analyses these values (on a monthly basis) at a make / model / spec / year level to drive the Fair Value analyses needed by its clients. Rouse’s rental and dealer clients provide Rouse with detailed transaction data on all the equipment they sell. This transaction data is routinely updated in Rouse’s database, providing a comparable-backed appraisal source for fair values.

Count on Rouse to deliver the most accurate fair value reports, supported by true market reference points and extensive experience. Contact Rouse for a free consultation on your fair value needs.

Recent Comments