Market update from Raffi Aharonian, Managing Director of Rouse Appraisals

With the landmark Orlando auction officially in the books—attracting 26,000+ bidders and generating US$213+ million in gross transaction value—it’s a good time to take a step back and see where the market has been and where it might be headed.

Since the onset of the pandemic in early 2020, we have experienced interesting market dynamics develop, carrying forward to present day where we are driving very strong pricing for consignors, but how did we get here?

Initial Pandemic Response

After the initial shock of global lockdowns in Q1 2020, we saw markets react abruptly with some sharp price reactions. For the equipment industry, the good news is downward pricing moves were short lived, on the back of the essential nature of construction work. Despite that, looming uncertainty caused a lot of disruption in terms of normal fleet replacement cycles. Rental companies, OEM dealers, and contractors deferred or cancelled orders placed earlier in the year, and many began selling equipment to right-size fleets in the event of a prolonged downturn.

Supply Shortfalls

As the demand for equipment continued to pick up throughout the end of 2020 and into 2021, we saw a combination of effects take hold. First, equipment owners sought to add to their fleets, calling on manufacturers for new orders, leaving manufacturers with extended lead times, on account of re-upping their production capacities to meet the sudden, renewed demand. Alongside that, the world saw supply chain disruptions and chip shortages, exacerbating the supply dilemma.

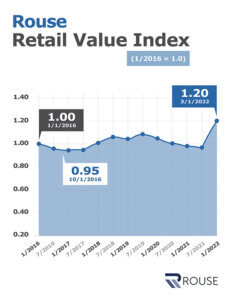

As a result, beginning in Q1 2021, used equipment pricing heated up, surpassing pre-pandemic levels, and eventually surpassing prior-peak levels, reaching a new five-year high. To date, we have not seen any slowdown in price increases for used equipment.

Demand Dynamics

While supply issues are continuing to make headlines across all industries, one of the untold stories of the pricing dynamic rests with the healthy levels of demand observed across the equipment industry. Total construction spend continues to rise, and manufacturers continue to report strong backlogs for equipment.

The demand story is particularly telling, by way of utilization trends across the rental industry, tracked uniquely by Rouse Analytics. In 2021, we observed rental utilization—a measure of demand for equipment out of rental fleets—exceeded levels achieved in 2020 and 2019. Further to that, YTD 2022 is demonstrating utilization levels that exceed the same time frame for each of the three preceding years. This, on the back of increasing fleet levels, indicates demand for equipment from end users and contractors remains very strong.

Present Day

As we look at the Rouse Value Index for auction pricing above, it’s clear pricing has reached recent highs, driven by a combination of supply challenges and strong buyer demand.

Importantly, as we look at price realization in the annual Orlando auction last month, we see pricing continuing to inflate.

To learn more about Rouse and its services, visit rouseservices.com.

Recent Comments