At bauma 2025, Ritchie Bros. will be showcasing our offerings as leaders in equipment market intelligence. Rouse Services, which provides complete end-to-end asset management, equipment valuations, and rental business performance benchmarking dashboards; and SmartEquip, an innovative technology that simplifies parts commerce for our partners and their customers while improving operational efficiency and customer experience with their procurement platform.

Ritchie Bros. will be at Stand B5.402, chatting with attendees and providing demos of our asset insights, products, and transaction solutions for companies in the construction sector looking to better understand equipment lifecycle management.

What is Rouse Services?

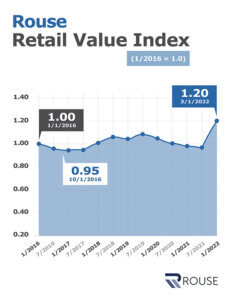

Rouse provides fleet appraisals, used machinery sales values, and rental company commercial insights for customers throughout North America, the United Kingdom, Europe, Australia, and Japan. Since 2000, Rouse has been building a legacy of deep expertise, unrivaled data precision, and unparalleled customer service. Dedicated to delivering timely equipment valuation metrics with accuracy and reliability, Rouse helps companies across the globe manage and efficiently disperse their equipment. With products such as Rouse Fleet Manager, Rouse Equipment Insights, Rouse Rental Insights and more, Rouse redefines the standards and service for appraisals, sales and marketing, and analytics.

The Rouse mission has always been to deliver accurate, actionable industry insights to help equipment owners make informed decisions about pricing strategies and fleet deployment. Rouse Rental Insights (formerly Rouse Analytics) was working with five companies in 2011, and today that has grown to over 400 across the globe. The industry data Rouse receives via these companies is then analyzed and transformed to deliver meaningful insights that help equipment owners and hire companies make decisions on which assets to purchase when, and how to deploy them, as well as to understand their sales performance.

How does Rouse gather and use data?

One of Rouse’s primary areas of focus is showing customers how to make their own data intelligible and actionable.

Rouse Rental Insights allows companies to measure their own performance against self-determined pricing and utilization strategies. By testing and learning from their own pricing and fleet management efforts, customers can optimize fleet decisions, clearly define the focus and performance of sales representatives, and better understand market supply and demand

A couple elements of data gathering and analysis that cannot be overlooked – and which Rouse takes very seriously – is compliance, accuracy, and trust. Rouse intakes, cleanses, standardizes, aggregates, anonymizes and transforms data so that no single participant is identifiable in the Rental Insights product, and a minimum number of contributors in a market and asset class are needed before any rental metrics will be released. In short, metrics are based on anonymized participant data that are aggregated, weight-adjusted and time-lagged.

Why do fleet owners use Rouse Services?

Rouse provides a powerful suite of solutions to help equipment owners better manage the lifecycle of their equipment to make intelligent business decisions every day:

- Planning & Deployment – Rouse Fleet Manager is a self-serve platform that centralizes fleet operations into a single, accessible place. Equipment owners can store photos, upload files and purchase orders, as well see basic equipment insights to help plan or sell machinery when it’s time to dispose.

- Utilization – Rouse Rental Insights provides equipment hire companies with aggregated, weight-adjusted and time-lagged industry benchmarks including metrics around sales performance in their local market to help support independent and unilateral strategic business decision making.

- Disposition – Rouse Fleet Manager with the Rouse Equipment Insights upgrade gives customers access to precise machine-specific equipment values to help equipment owners buy, sell and plan.

Test drive Rouse’s suite of equipment valuation and analytics products at Ritchie Bros. Stand B5.402. Sign up for free trial of these tools to see how you can make intelligent business decisions for your fleet.

Want to make an appointment to chat with us at bauma 2025? Follow the below link.

Recent Comments