NEWS RELEASE

Quipli Announces Integration with Rouse Services to Deliver Industry Benchmarking Data to Rental Businesses

ATLANTA, GA / BEVERLY HILLS, CA (10/15/2025) — Quipli, the fast-growing provider of cloud-based rental software, announced today a new integration with Rouse Rental Insights, an online product suite from Rouse Services, that provides equipment rental companies with benchmark reporting and performance data.

The integration allows Quipli equipment rental companies to automatically and securely transmit their fleet and rental data to Rouse, eliminating the need for manual exports or recurring data submissions. Rouse classifies the data into a common schema, then further processes it with like-kind industry data, to deliver subscribers accurate and reliable company performance metrics compared to aggregated, weight-adjusted, time-lagged and anonymized benchmark metrics. Metrics are made available in easy-to-use interactive dashboards, which customers can reference with other data and tools to better inform their independent business decisions.

Rouse: Equipment Market Intelligence

Rouse collects information on over US$49 billion in rental data per year and over US$115 billion of fleet from more than 400 participating rental companies and dealers across the globe. Reports offer industry recognized metrics based on Rouse-defined equipment categories and market levels such as:

- Rental rates

- Time and financial utilization

- Fleet age and turnover trends

- Rental growth

“This integration simplifies access to the gold standard in rental benchmarking data,” said Kyle Clements, CEO of Quipli. “It gives our mutual customers the ability to benchmark their operations with confidence, using data that can now flow automatically from Quipli into Rouse.”

How It Works

Quipli’s one-way integration transmits the necessary data to Rouse on behalf of the rental company. Insights and reports are then accessed directly through the Rouse Rental Insights platform. While the integration streamlines data transmission, a separate Rouse subscription is required to view reporting dashboards.

To get started, contact support@quipli.com, and we’ll connect you with the Rouse team to enable the integration.

About Rouse Services, LLC

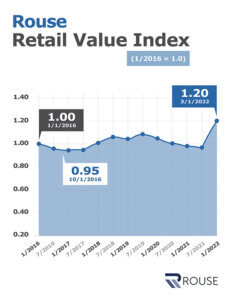

Rouse Services, LLC and its subsidiaries, part of RB Global, Inc. (NYSE: RBA) (TSX: RBA), are the industry standard for appraisal valuations, used equipment sales support, and rental metrics benchmarking. Rouse Rental Insights provides rental fleets with key performance and benchmark metrics to help make smart business decisions. Metrics used are calculated according to the American Rental Association’s Rental Market Metrics™ standards. Learn more at www.rouseservices.com.

About Quipli

Founded in 2020 and based in Atlanta, GA, Quipli provides an all-in-one rental management platform for equipment rental businesses. From online bookings and inventory tracking to accounting and dispatch, Quipli helps independent rental companies grow faster, now with simplified access to benchmarking metrics through Rouse Rental Insights.

Press Contacts

Evan Read, Head of Marketing at Quipli

evan@quipli.com / (310) 648-2550

Caitlin Brennan, Rouse Marketing Manager at RB Global

cbrennan@rbglobal.com / (203) 246-9926

Val Alitovska, Director of Corporate Communications at RB Global

valitovska@rbglobal.com / (312) 505-9900

Recent Comments